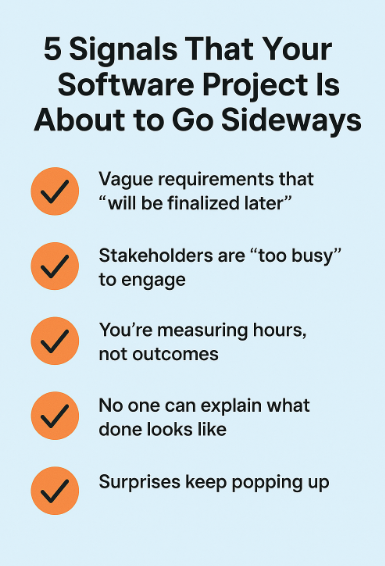

5 Signals That Your Software Project Is About to Go Sideways

Most failing software projects don’t collapse overnight. The warning signs are subtle at first—missed deadlines, vague answers, shifting priorities. But if you know what to look for, you can catch the cracks before they become chasms.

At Intertech, we’ve rescued enough troubled projects to know the patterns. Here are five signs your software project might be drifting off course—and how to steer it back on track.

1. Vague Requirements That “Will Be Finalized Later”

If your team is already coding while business requirements are still fuzzy, you’re gambling with time and money. Ambiguity upfront turns into expensive rework later.

Fix:

Push for clarity early. Use collaborative discovery sessions, detailed user stories, and prototypes to validate direction before writing production code.

2. Stakeholders Are “Too Busy” to Engage

If decision-makers aren’t showing up to key meetings or giving timely feedback, expect delays and mismatched expectations.

Fix:

Build stakeholder check-ins into the schedule. Use short, focused reviews to keep engagement high and decisions moving.

3. You’re Measuring Hours, Not Outcomes

When conversations revolve around “how many hours were billed” instead of “what was delivered,” the focus has already shifted away from value.

Fix:

Shift the conversation. Define milestones in terms of business outcomes or working software—not just time logs. (This is why Intertech’s UnifiAI focuses on real business impact through outcome-based delivery and AI-enhanced development.)

4. No One Can Explain What Done Looks Like

If developers, testers, and business leaders each have a different definition of “done,” brace for friction at release time.

Fix:

Use a shared Definition of Done. Spell out what’s required for a feature to be complete—from code to QA to stakeholder approval.

5. Surprises Keep Popping Up

Whether it’s unexpected dependencies, missed data fields, or newly discovered constraints—constant surprises usually mean poor planning.

Fix:

Invest time in project risk planning. Ask, “What could go wrong?” early and often. Good teams surface issues before they surface themselves.

Final Thought

No project is perfect. But recognizing these early signals—and acting on them—can mean the difference between a smooth launch and a budget-burning scramble.

If your project feels off and you can’t quite pinpoint why, we’re happy to take a second look. It’s what we do.