When a political proposal threatens your business, it is in the best interests of you and your employees to speak up in a public way. Hence, lesson #4: Engage your employees in the public debate as much as possible. We found this to be an effective technique when the Governor was pushing a proposal to tax business-to-business services recently.

When a political proposal threatens your business, it is in the best interests of you and your employees to speak up in a public way. Hence, lesson #4: Engage your employees in the public debate as much as possible. We found this to be an effective technique when the Governor was pushing a proposal to tax business-to-business services recently.

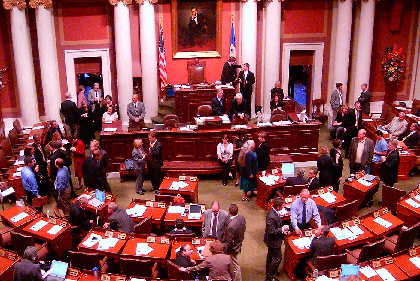

Intertech employees were provided with factual information about the issue and a tool for identifying their local representatives in the State Legislature. I also gave them a copy of my Star Tribune OpEd and encouraged them to send it to their local representatives with a personal note.

Many employees chose to engage on this issue, which resulted in an invitation to join a group of business leaders to meet with the Governor and selected state reps about the issue. We would not have been at the table without our proactive work with employees around this issue.

Thus, lesson #5: Don’t be afraid to take a position and speak out about it.

For some business people, it feels uncomfortable to get involved in a political discussion or debate. After all, we’re used to running our businesses not making governmental decisions. But the business community is a major stakeholder and decisions that impact our livelihood and the livelihoods of our employees deserve our time and attention.

But don’t go ballistic and (lesson #6), Don’t make idle threats. In the B2B debate, I was careful not to threaten relocating Intertech to another state. I did, however, describe the lobbying efforts of other states to lure businesses such as mine to their lower-tax jurisdictions. In the HBR case study, the lesson is stated as “Never, ever make a threat you’re not willing to follow through on.” Why? “Hollow threats undermine a company’s credibility, and that’s hard to recover from.”

I also believe that making threats create an environment that is hostile and nonproductive. Much better to (lesson #7) offer reasonable ideas and counter proposals that both parties can live with. I genuinely believe the Governor when he says he loves Minnesota and wants to build a strong future by beefing up education at all levels. and early learning opportunities for young children.

However, offering a paltry tax rebate to property owners seemed like a strange way to achieve that objective. I was not shy about pointing this out in my OpEd. I also acknowledged that while I’m not a fan of higher personal income taxes, I understand that more revenue is needed and that probably has to happen in some capacity to keep our state on a positive future course.

By meeting the Governor half-way on this issue, I hoped to show that I am a reasonable business person and a sincere Minnesota resident who deserves to have my thoughts about the B2B proposal seriously considered. The HBR case study summarizes this lesson this way: “Always look for a solution both parties can live with, even if it is not optimal for either one.”

My next post, and the last in this series, will look closer at lessons #8-10 on Fighting a Government Threat.

A recent article in The Economist had some interesting information on entrepreneurs based on a paper Small Business Activity Does Not Measure Entreprenurship by Magnus Henrekson and Tino Sanandaji:

A recent article in The Economist had some interesting information on entrepreneurs based on a paper Small Business Activity Does Not Measure Entreprenurship by Magnus Henrekson and Tino Sanandaji: