Why Most Software Projects Fail Before a Line of Code Is Written

When software projects go sideways, everyone looks at the developers.

But here’s the truth we’ve seen again and again:

Most failures happen before the first line of code is even written.

It’s not the coding. It’s what happens—or doesn’t happen—before coding starts.

1. The goals aren’t clear

Ask five stakeholders what success looks like, and if you get five different answers, you’re headed for trouble.

Without a shared definition of “done,” projects drag, priorities shift, and the final product pleases no one.

Fix it:

At Intertech, we don’t write code until everyone agrees on goals, guardrails, and outcomes. No guesswork. No assumptions.

2. Requirements are rushed

“We need a login, some reports, and a dashboard.” That’s not a spec—it’s a wish list. Too many projects jump into development with vague features and unclear logic.

Fix it:

Slow down to speed up. We workshop requirements, ask hard questions, and pressure test assumptions before a developer touches the keyboard.

3. The users are missing

We’ve seen projects stall because they were built for what management thought users wanted—not what users actually needed. That disconnect is expensive.

Fix it:

User interviews. Prototypes. Feedback loops. Involve the people who will live with the software from day one.

4. There’s no plan for change

Scope creep doesn’t kill projects—poor change management does. Requirements shift. Priorities evolve. But if you don’t have a process to manage that, chaos takes over.

Fix it:

We build in checkpoints. We communicate trade-offs. And we use tools that make it easy to update without blowing up the timeline.

5. The team is misaligned

Even with great tools and talent, if your internal team and your vendor aren’t on the same page, it shows. Missed messages. Missed deadlines. Missed expectations.

Fix it:

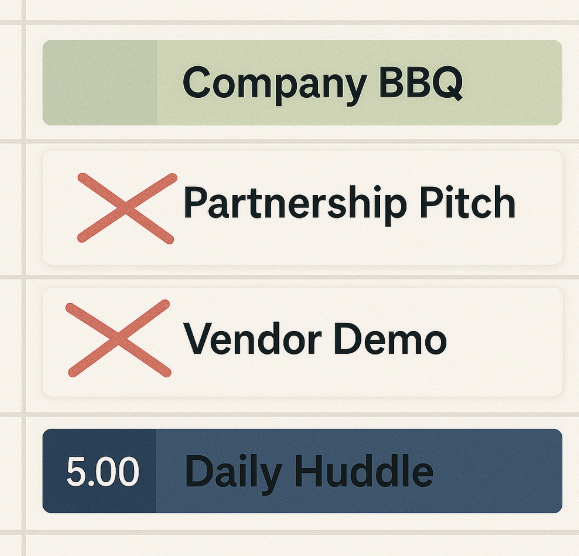

We overcommunicate early. Daily huddles, shared channels, clear escalation paths—because alignment beats brilliance every time.

The takeaway?

A successful project starts before the kickoff.

It starts with clarity, discipline, and a partner who’s not afraid to slow down to get it right.

We’ve seen it. We’ve learned it. We build for it.